Insure Foreign Accounts Receivables – Gain Additional Working Capital

As companies expand globally we want to highlight how a trade credit insurance policy can provide enhancements for working capital and help fund growth.

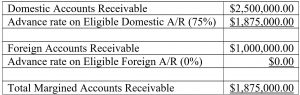

As part of working capital most lenders will consider domestic receivables and advance a percentage of eligible borrowing base. Today, foreign receivables are excluded from the borrowing base.

See below for a quick demonstration of how a trade credit policy can assist a $20 million dollar company:

Without Insurance

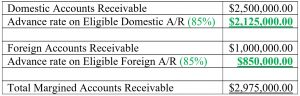

Now, let’s look at the same borrowing base and assume foreign and domestic receivables are insured through Robertson Ryan & Associates. By utilizing trade credit insurance, lenders will often advance up to 70%-85% on the eligible foreign receivables and will collaterize previously ineligibles such as concentrated or aged receivables.

See below for a quick demonstration on the impact to both foreign and domestic borrowing bases:

With Insurance

For this $20M manufacture they were able to increase working capital nearly $1,100,000 by investing $25,000. By insuring your foreign accounts receivables, companies can gain access to additional borrowing base and fund growth!

Robertson Ryan & Associates is a Top 50 Property and Casualty Agency that also specializes in Trade Credit, working with major carriers to provide our clients an understanding and tools to manage a trade credit policy.

If you have questions, or would like a better understanding of how to maximize your lending capacity, please contact me.