Coverage Cancellation

During 2020 and throughout the COVID-19 and the economic uncertainty many companies utilizing trade credit insurance were surprised, confused, angered, disappointed, intrigued, glad, and better informed after their trade credit partners cancelled partial or all of the limits associated with a customer. Trade credit insurance has nuances that many other lines of insurance do not have, one in particular is the focus point of this article. What happens when my insurance company cancels coverage and why?

Anytime coverage under a trade credit policy is cancelled there is always initial confusion and the best position to be in, is one of being well informed. Working with your trade credit broker to understand the policy parameters, coverage options, reason for cancellation and plan to move forward is critical to your success.

Policy Parameters –

- Policies “should” and most times come with a delayed cancellation period. Allowing time to have discussions with current debtor, restructuring payment terms and opportunity to provide additional information. Important to remember, outstanding AR is still covered

- Claim filing requirements – being prepared for a claim situation is key to having the policy activate. Each carrier and each policy has claim filing criteria important to understand your obligations if you choose to file a claim

- Cancellation vs a Discretionary coverage – trade credit policies are an information source and important to understand that under most policies after a limit is cancelled, so too is the option for discretionary coverage

Coverage Options – working with a broker provides access to alternative coverage options

- AR Put Options – account receivable PUT options are available for both privately held and publicly held entities or more marginal risks. Priced anywhere from .1% – 3.5% monthly, PUTs are an additional source of protection

- Excess Coverage – many carriers offer coverages “in” addition to the core coverage for an additional premium. These coverages are consider commercial tools that usually are priced on the market for additional coverage from 0 – 2x current limits.

The WHY – understanding the “why” to the cancellation, is the most important piece of the puzzle. Trade credit policies are a source of valued information. Working with your trade credit broker there are several key things your broker could and SHOULD be doing:

- Understand what information the insurance carrier has and how that decision is being made

- Provide opportunities to speak with underwriters or become better informed about status of debtor

- Create a marketing plan of how to source additional information from the debtor, if needed, by contacting and discussing the current credit decision

- Appealing decision and working with the current insurance company to advocate on your behalf for optimal level of coverage

When coverage is removed from a policy it is great information that isn’t great news. The carriers and the policies are an immense source of information to help widen the credit lenses of your company.

Robertson Ryan has a trade credit division with experts to help you manage, educate and understand your policy and navigate any situation. If you’re unhappy, confused or feel you could use experts on trade credit policy we are happy to assist with any questions.

Trade Credit Insurance

Extending credit to your clients isn’t just a nice perk, it’s expected in today’s business climate. Credit not only enhances the purchasing power of your customer base, it can also attract prospects that may not have otherwise been able to buy from you.

However, offering credit or extending credit has the potential for disaster, as just one late payment or customer insolvency can put stress on your organization’s cash flow and profitability. That’s where trade credit insurance can help. Trade credit insurance, also known as credit insurance or account receivable insurance, is a form of insurance that transfers risk for businesses seeking to protect their accounts receivable against nonpayment or insolvency.

Here are two real life scenarios of how trade credit was used to protect companies in the Midwest.

Claims Scenario: Willingness v Ability

The company: A midsized retail company that specializes in textiles, toys and accessories

The challenge: The company recently completed a large transaction with reputable, financially sound big box retailer. The big box store had placed a six figure PO with company for an order to be imported oversees and delivered to the retailer. After receiving the order the retailer decided they no longer wanted or needed the supplies and was refusing to pay. Being the big box was a larger organization they tried to negotiate a percentage of what was owed as a settlement. The client having trade credit consulted on their options and decided to file a claim against the retailer (Know Your Policy). After due process from the carrier a check was paid to client for amounts owed within 60 days of claim being filed.

Trade credit insurance in action: When a customer can no longer make payments, or in this case becomes unwilling to make a payment it has an impact on the organization offering goods. For the company above having the backing of trade credit allowed for them to pursue the full amount owed and not settle. When one customer abuses credit, it affects an organization’s ability to extend credit to other customers and overall cash flow. In instances like this, trade credit insurance is invaluable at willingness vs ability to pay.

Claims Scenario: Growing Pains

The company: A growing manufacture

The challenge: An automotive manufacturer was looking to expand their operations overseas due to the new revenue potential. However, because the company was so young, it was difficult to take any major risks – risks like expanding to new markets. This hurt the organization when an international buyer approached them and wanted to place a large order.

While the purchase would have been the biggest in the manufacturer’s history, the deal fell through. The customer didn’t have enough working capital (Insure Foreign AR) to get the deal done on cash and it was too risky for the auto manufacturer to take the buyer on credit.

Trade credit insurance in action: Without the right coverage, every sale you make on credit is a gamble. For the automotive manufacturer above, trade credit insurance would allow the organization to provide prospects with more ways to close a deal both financially and from a credit standpoint.

Trade credit insurance can also be incredibly beneficial for young companies, as it helps combat concentration risks. This means that, if the auto manufacturer relied on a few large accounts to stay afloat, they are protected in the event that their best customers become insolvent.

Source: Gary Daggett & Zywave

Insure Foreign Accounts Receivables – Gain Additional Working Capital

As companies expand globally we want to highlight how a trade credit insurance policy can provide enhancements for working capital and help fund growth.

As part of working capital most lenders will consider domestic receivables and advance a percentage of eligible borrowing base. Today, foreign receivables are excluded from the borrowing base.

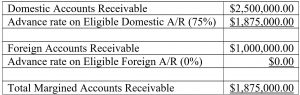

See below for a quick demonstration of how a trade credit policy can assist a $20 million dollar company:

Without Insurance

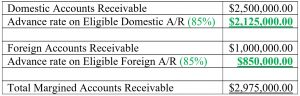

Now, let’s look at the same borrowing base and assume foreign and domestic receivables are insured through Robertson Ryan & Associates. By utilizing trade credit insurance, lenders will often advance up to 70%-85% on the eligible foreign receivables and will collaterize previously ineligibles such as concentrated or aged receivables.

See below for a quick demonstration on the impact to both foreign and domestic borrowing bases:

With Insurance

For this $20M manufacture they were able to increase working capital nearly $1,100,000 by investing $25,000. By insuring your foreign accounts receivables, companies can gain access to additional borrowing base and fund growth!

Robertson Ryan & Associates is a Top 50 Property and Casualty Agency that also specializes in Trade Credit, working with major carriers to provide our clients an understanding and tools to manage a trade credit policy.

If you have questions, or would like a better understanding of how to maximize your lending capacity, please contact me.

Great! We had Trade Credit Insurance…will we get paid?

The moment your customer files bankruptcy protection, an automatic stay goes into effect. Having a trade credit policy to protect your accounts receivables is imperative for any business whether it’s small or big, domestic or international. However, just having a policy doesn’t always ensure, you will be paid 100%.

Let’s take a deeper look at some common scenarios when a trade credit policy does not pay and how you can properly manage your policy.

Debtor not listed on Policy – Business is hectic, sales are frantic and people are wearing multiple hats, but not having customer listed on policy isn’t going to allow carrier to underwrite.

What should you do…Create defined credit onboarding practice

Over shipped Permitted Limit – Sales is KING! Going above the assigned limits leaves partial unpaid exposure

What should you do…Review limits and AR biweekly/ monthly and input credit stops at assigned limits

Negotiated Longer Terms – Customers are pushing for extended terms but extending past agreed terms could be a reason for denial

What should you do…Input safeguards, hard fast rules of n30/n60 or n90

Missed a Claim Filing Window – Assuming you will get paid and kicking the can down the road could cause you to miss the claim filing window from the carrier.

What should you do…Reduce DSO and Increase collectability by taking action 60, 90 days past due

Didn’t Report Past Dues – Carriers want to know past due information to make more analytical decisions, but miss reporting could be a reason

What should you do…Review 1st of month, calendar reminders. No past dues – good news!

Someone once told me that all legitimate claims are paid! – A trade credit policy is a very viable tool for all business’s selling on credit. It is intricate for a business to understand how to manage and utilize the policy.

Robertson Ryan & Associates is a Top 50 Property and Casualty Agency that also specializes in Trade Credit, working with major carriers to provide our clients an understanding and software tools to ENSURE our clients do not miss the 5 common mistakes above.

Policy compliance is key and in the day of automation and we would appreciate the opportunity to help you understand how we can achieve that and eliminate the denials. If you have questions, or would like a better understanding of how to maximize your policy with minimizing the grey areas please contact me.

The Bold

Each month Robertson Ryan & Associates features an agent who is ‘Thinking Big & Acting Bold’. This month, I was selected as the featured agent and spoke about Trade Credit Insurance and how I can be of assistance to you.

Further questions, just ask! Contact Me

Is it Time to Consider Trade Credit

As we move on from 2020 one piece of insurance is growing exponentially in the interest of our clients. Trade Credit Insurance or Accounts Receivable insurance is a protection on your receivables, domestic or foreign against non-payment, slow payment, political risk or a formal bankruptcy. At its core it is straight forward, simple, and yet one most companies don’t consider! Account Receivables for most companies are one of their top 3 assets. Typically, representing more than 40% of a company’s assets and an area with the economic uncertainty, most susceptible for a loss.

Insolvencies continue to rise, Days Sales Outstanding continue to increase and companies are doing more with less. So let’s look at 5 tangible ways a trade credit policy has helped SMEs just like yours.

- Credit Management – today all pillars of business are being disrupted and automated with big data and analytics. Most companies today still an outdated model for credit gathering references, a mercantile report or a “knock on wood” haven’t been burned yet. So why not a better way? Trade credit carriers are using analytics from payment history, mercantile reports, financials public/private and banking information to package a profile to widen your credit lens capabilities.

- Sales Growth – no one ever wants to suffer an expected or unexpected bad debt loss, but is having no losses a healthy mix of risk appetite? Trade credit allows for you to extend greater terms, larger exposures or be informed about new risks to grow. In a $5m company with margins of 15-20% and terms of n30 you’d only need 2 NEW customers spending $5k a month to recoup your investment.

- Bad Debt Reserves – CASH is KING, yet a practice among many is stashing cash, non-tax deductible on a balance sheet to plan for the unexpected. Trade credit allows for you to recognize a one-time win, while establishing a sophisticated credit management process by releasing your bad debt reserves. You don’t put money in a savings account expecting to play bumper cars one day!

- Access to Capital – as Covid19 continues to lag, many companies are relying on their cash flow and sometimes even PPP loans to sustain. A trade credit policy helps to collaterize your receivables so your lending institution can recognize a secured asset.

- Sleep Insurance – in this day and age as a business owner, couldn’t we all use a little certainty, knowing we will get paid for the work you’ve done?

Trade Credit isn’t just for the big corporations. We are excited to launch the Trade Credit Division at Robertson Ryan & Associates. We are here to help you better understand trade credit, partner with the major carriers and develop a program that matches your needs. Contact us, Follow our LinkedIn or visit our website to gain more insights.

Authored by Gary Daggett – Trade Credit at Robertson Ryan & Associates – 612.860.5829 – www.robertsonryan.com/tradecredit